Social Media Activity Indicators and Return Predictability

This is a study done with Prof. Sadka, where we try to understand the abnormal

returns caused by social media activity in the short-term. In this study, we:

- Developed firm-level indicators using Natural Language Processing (NLP) techniques on unstructured daily data from 300 social media sources.

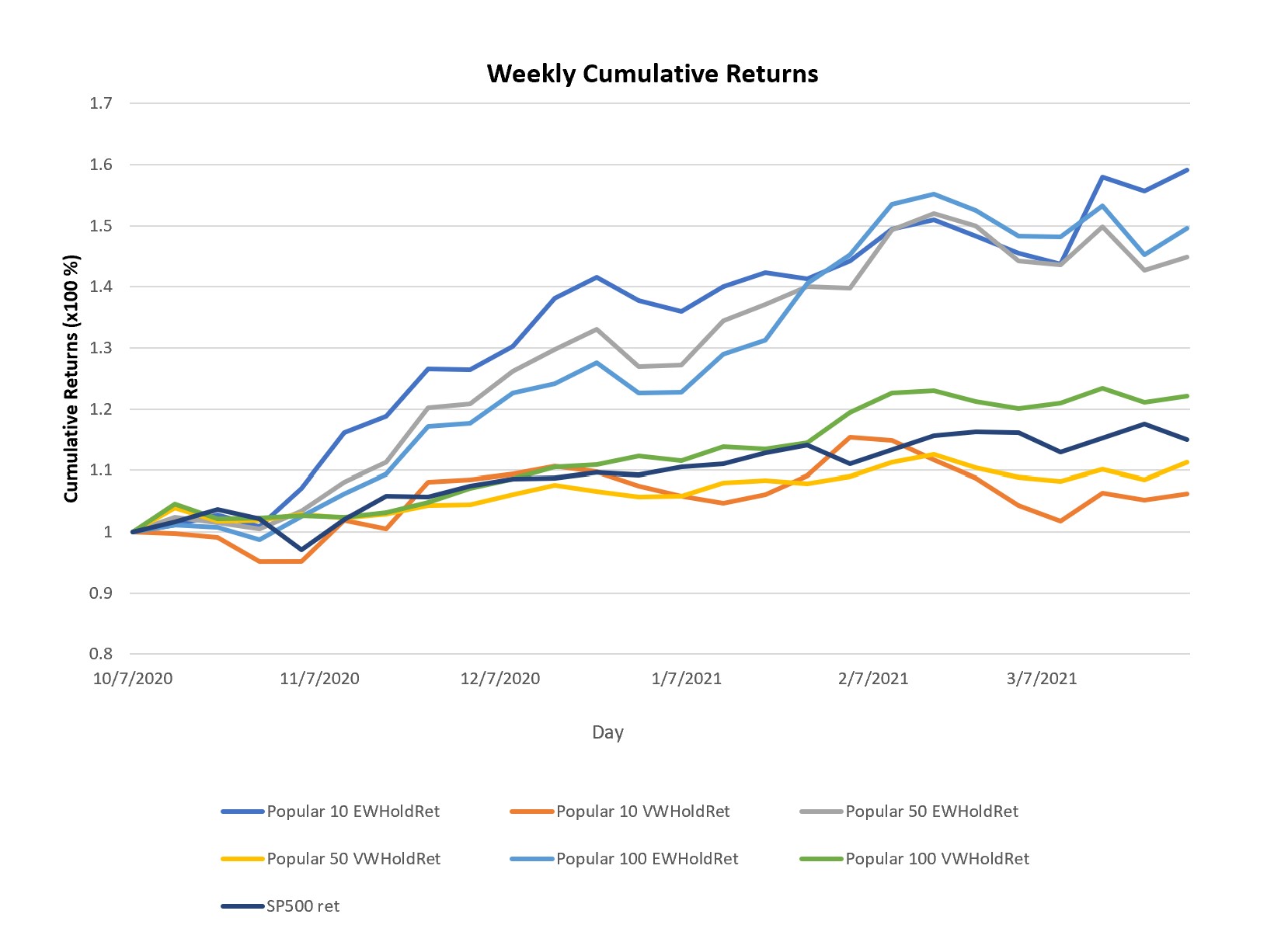

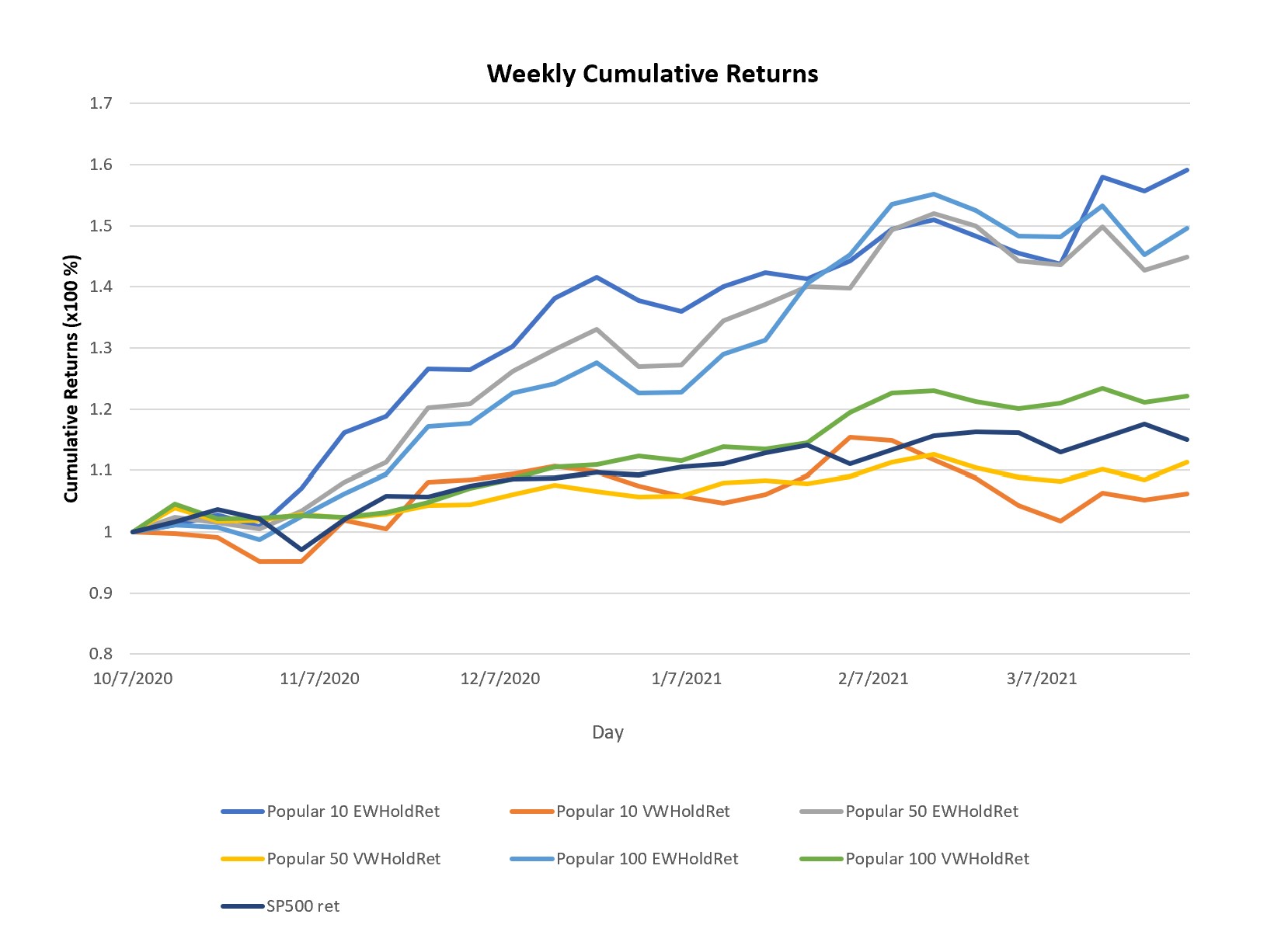

- Constructed weekly rebalanced value-weighted and equal-weighted portfolios based on these indicators, generating annual alphas of up to 50% for the year 2020-2021.

- Demonstrated significant predictive power of returns for the social media-derived activity indicators based on Fama-Macbeth regressions, which involves estimating time-series regressions for each cross-sectional

period to examine the average relationship between independent and dependent variables, and its statistical significance.

- Extracted abnormal returns through Fama-French factor models, which were not explained by the conventional risk factors that financial assets are exposed to.